- What Is Copayment With Deductible

- $30 Copay After Deductible What Does That Mean

- What Does $30 Copay After Deductible Mean

- Copay Before Deductible Vs After

Note:

1) Plan payments for covered health services are based on usual and customary charges.

2) Should there be a conflict between this summary and the Plan Document, the Plan Document will be the final authority.

* Custodial care is not a covered health service

** Shingles vaccination is covered under Medical and Prescription Drug plans

*** No need to coordinate with Medicare

Although Con Edison currently sponsors the Retiree Health Program, the information above does not alter the company’s right to change or terminate the program at any time due to changes in laws governing employee benefit plans, the requirements of the Internal Revenue Code, Employee Retirement Income Security Act, or for any other reason. The company is not obligated to contribute any fixed amount or percentage of program costs.

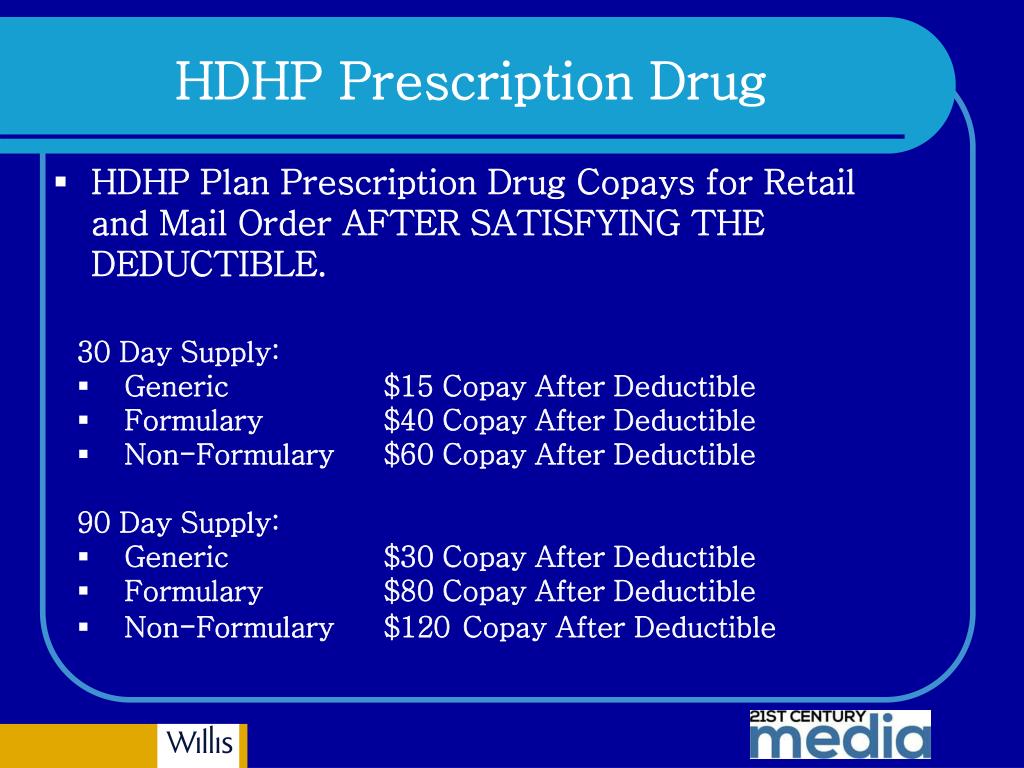

$100 copay after deductible, waived if admitted to hospital Emergency Medical Transportation. Insurance after deductible Routine Vision Care $30 copay $20 copay In-Network: $0 Out-of-Network: 20% co-insurance after deductible Once every 12 months Once per plan year. 4 Small Group PPO $30 Copay Plan All amounts listed are the member’s responsibility to pay after deductible(s), unless otherwise noted. In-network negotiated fees can result in 30 to 40% savings compared to providers’ usual fees. 30% coinsurance after deductible Not Covered Requires preauthorization for certain services, failure to obtain preauthorization may result in denial of benefits. Limited to plan requirements.See Section 3(e). Hospice services $60 copay after deductible/day 40% coinsurance after deductible in an inpatient setting.

What Is Copayment With Deductible

Notice of Privacy Practices$30 Copay After Deductible What Does That Mean

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is a federal law that requires Con Edison and the health plans sponsored by the company to protect your personal health information (PHI). As a participant under one of the health plans offered by Con Edison, we are required to notify you of the privacy practices that will be followed by the company and the plans and your rights concerning your personal health information.

What Does $30 Copay After Deductible Mean

Under the law and privacy practices, we have the responsibility to protect the privacy of your personal health information by:

Copay Before Deductible Vs After

1. limiting who may see it

2. limiting how we may use or disclose it

3. explaining our legal duties and privacy practices

4. adhering to these privacy practices

5. informing you of your legal rights